February 19, 2026

Key Highlights

- NYC needs at least 16,000 more seats for schoolchildren starting at 3 years old

- Retail rents average $55.16 per square foot, with prime locations hitting $574 PSF, squeezing operators out of viable space

- Despite tax abatements of up to $350K–$750K for building childcare facilities, developments remain low due to poor awareness and complex permitting

The Reality Behind NYC’s Universal Childcare Push

As brokers at NYCCREA, we are seeing firsthand how New York City’s universal childcare initiative, which is backed by a $4.5 billion commitment from the government, is colliding with a hard truth. You can’t expand childcare without space and NYC doesn’t have enough of it.

While demand for childcare continues to surge, especially with plans to expand services to 2-year-olds, the physical infrastructure needed to support this system is lagging far behind.

Based on a report of CRE Daily, we’re seeing a fragmented landscape:

- Some neighborhoods face long waitlists

- Others have unused capacity

- And there is no centralized data system tracking available childcare spaces

Meanwhile, 96,000 existing pre-K seats lack full-day or year-round options, leaving working families scrambling for solutions.

The Core Challenges Slowing Childcare Expansion

From our vantage point in the market, the biggest obstacles are not policy ambition but real estate execution.

1. High Retail Rents Are Pricing Out Operators

- Citywide average retail rent sits at $55.16 per square foot

- Prime corridors reach as high as $574 PSF

- In some areas, childcare costs now exceed rent, making affordability unsustainable

Most childcare providers simply cannot compete with traditional retail tenants for space.

2. Zoning Restrictions Severely Limit Inventory

- Regulations require childcare facilities for younger children to be located on the ground floor

- This significantly narrows already scarce options in dense urban areas

The result is clear: plenty of space exists but not the right kind of space.

3. Permitting and Licensing Delays Stall Openings

Operators consistently report:

- Slow city approvals

- Certificate-of-occupancy delays

- Complex licensing processes

Even when a space is secured, it can take months or years to open.

4. Severe Supply-Demand Imbalance

- NYC needs 16,000 additional seats for its 3-K program which provides brings free, full-day education to three-year-old children

- Only 29% of income-eligible children access subsidized care

- Demand is expected to rise further

This gap represents both a social challenge and a real estate opportunity.

5. Lack of Data and Site Discovery Tools

- There is no single platform identifying viable childcare locations

- Brokers, landlords, and operators often work with incomplete information

This inefficiency slows deal flow and limits scalable expansion.

6. Incentives Exist But Adoption Is Low

- Tax abatements offer up to $350,000 per project

- Up to $750,000 in designated childcare deserts

- Only 47 projects utilized earlier versions

The issue isn’t funding but public awareness and accessibility.

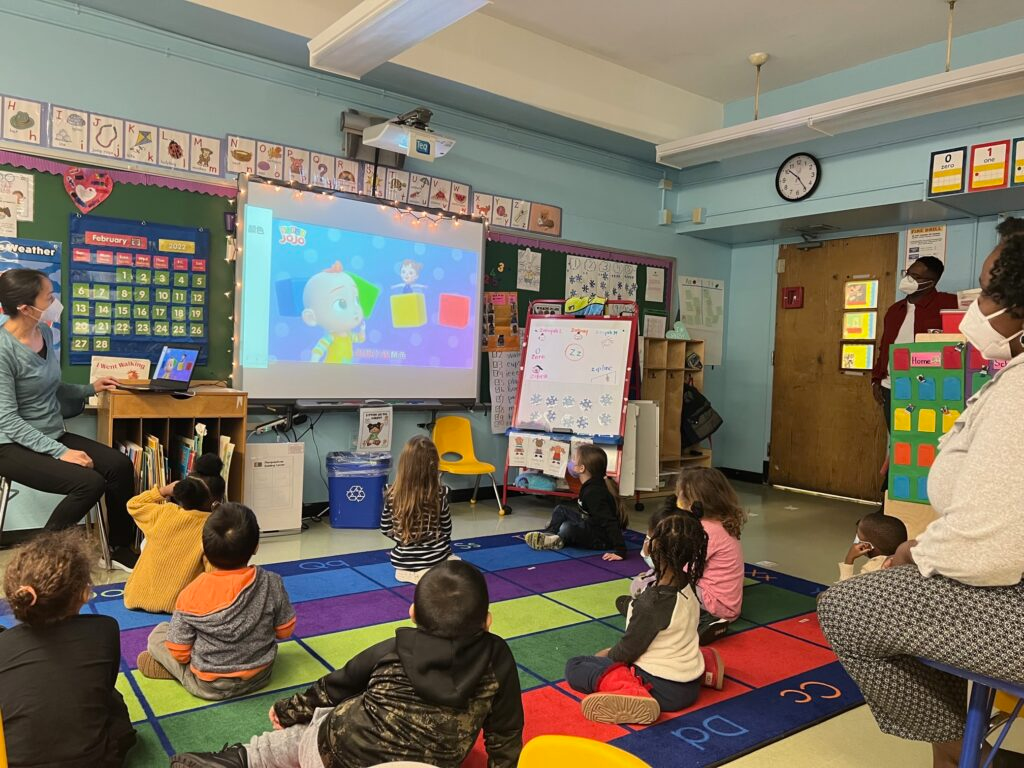

In New York City, families can apply to 3-K in the calendar year their child turns three. 3-K brings free, full-day, high-quality education to three-year-old children in New York City. (Photo: Brooklyn Bridge Parents)

How CRE Policy and Development Can Unlock Growth

To close the childcare gap at scale, we need coordinated action between policymakers, landlords, and brokers. Here are our takes on how government policies and commercial real estate developments can address the burgeoning situation in childcare facilities.

1. Increase Awareness of Tax Incentives

One of the biggest barriers is not the lack of incentives, but the market’s lack of understanding of how to use them.

- Expand outreach to landlords and brokers

- Package abatements into clear, actionable deal structures

Incentives only work if the market understands and uses them.

2. Encourage Landlord-Operator Partnerships

Given high rents, collaboration between landlords and childcare operators is becoming essential to make deals viable. We are seeing growing interest in:

- Discounted rent structures

- Tenant amenity childcare centers

- Mixed-use developments with integrated childcare

These models allow landlords to trade short-term rent for long-term asset value.

3. Streamline Zoning and Permitting

Time and regulatory complexity remain some of the most significant cost drivers in childcare development.

- Expand allowable locations beyond ground floor requirements

- Fast-track approvals for childcare use

- Simplify certificate-of-occupancy processes

Time is the biggest hidden cost in childcare development.

4. Activate Underutilized Spaces

Unlocking existing inventory is the fastest way to increase childcare capacity without waiting for new construction.

- Community facility spaces

- Vacant retail

- Office-to-childcare conversions

Adaptive reuse can rapidly unlock inventory.

5. Build a Centralized Childcare Space Database

A lack of reliable data continues to slow the matching of operators with viable spaces.

- Track available, compliant, and potential sites

- Connect operators with landlords in real time

Data transparency would dramatically increase deal velocity.

6. Integrate Childcare into New Developments

Future supply must be embedded into development pipelines rather than treated as an afterthought.

- Require or incentivize childcare in large residential projects

- Position childcare as core infrastructure—not optional retail

As demand grows, childcare becomes as essential as housing.

Despite ongoing concerns about space and facilities, every school district offers 3-K programs, and New York City makes every effort to place students in available seats close to their homes. (Photo grab from New York City Department of Education)

Childcare as Strong Investment in 2026

We believe NYC’s childcare expansion is at a critical inflection point. The funding is in place, demand continues to rise, and policy momentum is strong, but the real estate ecosystem has yet to catch up. Without meaningful intervention, the mismatch between policy goals and physical infrastructure will persist, leading to slower rollouts, uneven distribution of services, and continued pressure on families and operators.

From our perspective, the biggest constraint is not capital. It is execution. High rents, restrictive zoning, fragmented data, and slow approvals create friction at every stage of development. Until these bottlenecks are addressed, even well-funded programs will struggle to scale efficiently across the city.

However, based on a report of CRE Daily, we are also seeing early indicators of change. Increased landlord inquiries following updates to tax abatements suggest growing awareness. More owners are exploring childcare as an amenity to attract and retain tenants, particularly in mixed-use and residential developments. At the same time, adaptive reuse strategies are gaining traction as a faster path to delivering new facilities.

Looking ahead, we expect the market to evolve in phases. In the short term, growth will remain incremental as operators navigate existing constraints. In the medium term, targeted policy reforms and stronger collaboration between the public and private sectors could unlock significant supply. Over the long term, childcare has the potential to emerge as a defined asset class within commercial real estate, driven by sustained demand and public investment.

Ultimately, universal childcare is not just a policy initiative. It is a real estate challenge that requires coordinated solutions. As brokers, we see a clear opportunity for those who can navigate incentives, identify viable sites, and structure creative deals. The firms that position themselves early will be best placed to lead in what is quickly becoming one of the most important and underserved segments of the market.

For the latest news, proven strategies, and exclusive opportunities in commercial real estate in New York City and Western Nassau County NY, visit us at www.nyccrea.com

FOLLOW US:

Facebook: www.facebook.com/newyorkcityCREA

Instagram: www.instagram.com/nyccrea

LinkedIn: www.linkedin.com/company/nyccrea