December 19, 2025

3 Key Takeaways at a Glance

- 4.1 million square feet converted in just 8 months

Office-to-residential conversion starts reached 4.1 msf in 2025 through August, already surpassing all of 2024’s 3.3 msf and more than doubling 2023’s 1.6 msf. - Midtown has flipped the script

Since 2020, 54.8% of conversions are now in Midtown, compared to 23.4% pre-pandemic, signaling a major geographic shift in where underperforming offices are being repositioned. - Lower vacancy but impact is gradual

Converting potential Manhattan offices to apartments would only slightly lower the vacancy rate from 22.3% to 21.5%, demonstrating that while conversions help, they offer only an incremental solution to the city’s massive oversupply of office space.

Why Conversions Are Happening Fast

As NYC commercial real estate brokers on the ground every day, we’ve seen firsthand how dramatically the office market has changed since the pandemic. With Manhattan office vacancy still above 20.0% and peaking at 23.8% in June 2024, owners of older office buildings are facing a hard truth: many assets no longer align with how tenants work today.

What’s changed is not just demand but feasibility. Residential conversions, once constrained by zoning and economics, are now accelerating thanks to policy reform, pricing resets, and housing demand. According to Cushman & Wakefield’s September 2025 report, the past two years represent a clear break from the pre-COVID norm, when conversion starts averaged less than 1.2 msf annually from 2004–2022.

Since 2024 alone, 20 Manhattan office sales have involved buildings already slated for—or actively undergoing—residential conversion. From our perspective, this isn’t a niche strategy anymore. It’s becoming a core part of NYC’s reset.

Market Drivers We’re Seeing Play Out

- Post-COVID acceleration

Conversion starts jumped from a historical average of <1.2 msf per year to 1.6 msf in 2023, 3.3 msf in 2024, and 4.1 msf in 2025 (YTD through August). - Sustained vacancy pressure

Even after easing from its peak, Manhattan office vacancy sits at 22.3% as of August 2025, more than double the pre-pandemic five-year quarterly average of 9.4%. - Asset repositioning as survival

These elevated vacancies are pushing owners to rethink underperforming assets, with residential reuse emerging as a compelling “higher and better use.” - Housing tailwind

Each conversion doesn’t just remove obsolete office space. It also helps chip away at the city’s persistent housing shortage, strengthening both market and policy support.

The Catalyst Behind the Surge

From our vantage point, state policies have been the accelerant.

- The Office Conversion Accelerator Program (2023) reduced administrative challenges, updated zoning, and addressed office vacancies and housing shortages through adaptive reuse.

- The 467-m tax incentive (2024) served as a turning point that materially improved project feasibility as it offers property tax exemption for converting commercial buildings into residential ones.

- The City of Yes zoning reforms expanded conversion eligibility citywide and updated the floor area ratio (FAR) cap which allows developers to build more apartments on the same amount of land.

- The Midtown South Mixed-Use Plan approval aims to create about 9,500 new homes, including 2,800 permanently affordable homes.

Looking ahead, the pipeline is telling. An additional 8.8 msf of conversions are proposed, nearly matching the total volume of conversion starts since 2023.

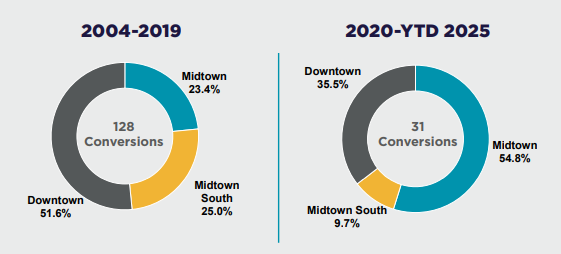

Conversion Number: Buildings by Market

- 2004–2019 (Pre-Pandemic)

- Downtown dominated with 51.6% of conversions.

- Midtown accounted for just 23.4%.

- Since 2020

- Midtown now leads with 54.8% of all conversions.

- Downtown’s share declined to 35.5%.

- Current pipeline (25 proposed buildings)

- 48% in Midtown

- 40% in Downtown

From what we’re seeing, Midtown’s rise reflects both aging office stock and new zoning flexibility, while Downtown had already absorbed decades of conversions dating back to the 1990s.

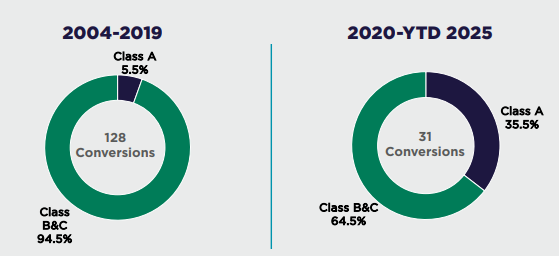

Conversion Number: Buildings by Class

- 2004–2019

- Class B & C buildings made up 94.5% of conversions.

- Class B & C buildings made up 94.5% of conversions.

- Since 2020

- Class A conversions jumped to 35.5%, signaling that even higher-quality assets are not immune.

- Class A conversions jumped to 35.5%, signaling that even higher-quality assets are not immune.

- Proposed pipeline

- 52% of future conversions are Class A, marking a structural shift in how deeply post-pandemic trends are reshaping the market.

- 52% of future conversions are Class A, marking a structural shift in how deeply post-pandemic trends are reshaping the market.

We’re also seeing projects get bigger. The average converted building size more than doubled, from 157,937 sf (2004–2019) to 325,982 sf since 2020.

How Conversions Impact Office Vacancy

Manhattan

- Office inventory

- From 415.1 msf (August 2025)

- Down to 406.4 msf if all conversions proceed

- Vacancy rate

- From 22.3%

- Down to 21.5%, assuming tenant relocation within the city

From our standpoint, this is directionally positive but modest. In a market as large as Manhattan, conversions help, but they’re not a silver bullet.

Downtown

- Office inventory

- From 83.2 msf

- Down to 79.6 msf

- Vacancy rate

- From 22.3%

- Down to 20%, a 230-basis-point reduction that shows a pattern of adaptation through reuse and redevelopment

Downtown’s smaller inventory makes conversions far more impactful. A prime example: 25 Water Street, a 1.1 msf conversion delivering 1,320 residential units, now stands as the largest office-to-residential conversion in U.S. history.

Our Take as NYC Commercial Brokers

The surge in office-to-residential conversions confirms what we’ve been advising clients since the pandemic. New York’s office market is not just cycling—it’s recalibrating. Conversions won’t singlehandedly solve a 22%+ vacancy environment, but they are a meaningful pressure valve, removing obsolete supply, stabilizing challenged assets, and adding much-needed housing.

Backed by supportive policy, reset valuations, and sustained residential demand, we expect conversions to remain a central feature of NYC’s commercial real estate landscape for years to come. From where we sit, this isn’t a temporary trend. It’s a structural shift in how the city rethinks space.

For the latest news, proven strategies, and exclusive opportunities in commercial real estate in New York City and Western Nassau County NY, visit us at www.nyccrea.com

FOLLOW US:

Facebook: www.facebook.com/newyorkcityCREA

Instagram: www.instagram.com/nyccrea

LinkedIn: www.linkedin.com/company/nyccrea