December 10, 2025

Highlights we’re seeing on the ground:

- Investment volume across the tri-state climbed to $8.8B in Q2 2025, up 11% year over year.

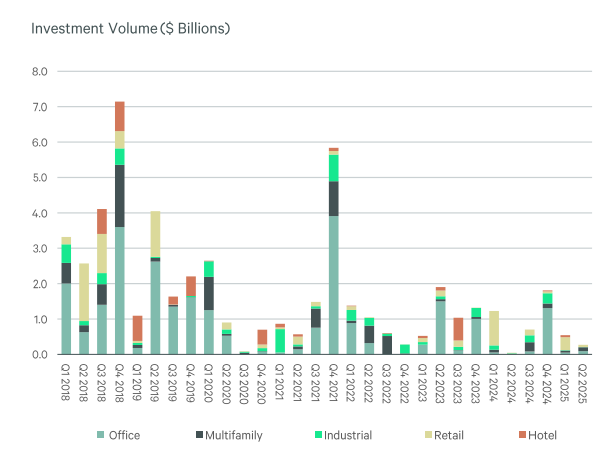

- Multifamily continues to lead the pack with $2.6B in deals — followed by $2.2B in office and $1.7B in industrial.

- Private buyers remain the most active, making up over 60% of the region’s recent deal volume.

We at the New York City Commercial Real Estate Advisors (NYCCREA) have felt a strong comeback this year — and the numbers back it up. The CBRE 2025 H1 Tri-State Capital Markets report reflects what we’re seeing every day: more calls, more tours, more offers, and more capital looking for smart opportunities across multifamily, office, and industrial assets.

The first half of 2025 has been defined by renewed confidence, steady investor appetite, and stronger-than-expected activity across several categories. Below is how the landscape is taking shape from our vantage point.

What We’re Seeing Across the Tri-State

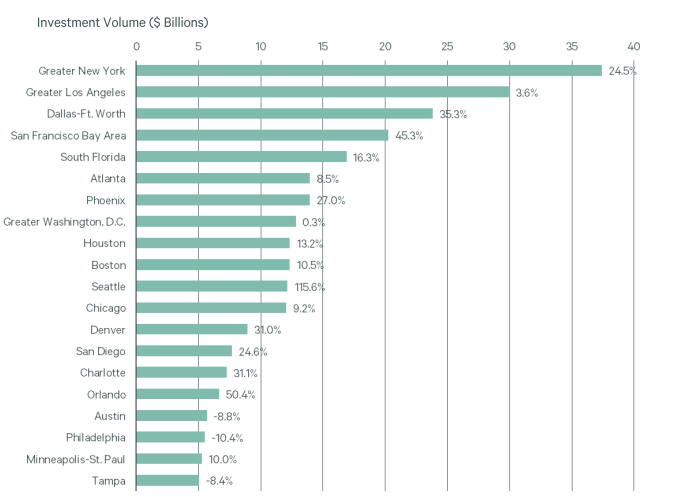

- New York led all U.S. markets in total investment volume over the trailing four quarters ending Q2 2025, pulling in more than $37 billion, ahead of both Los Angeles and Dallas.

- While Manhattan has slowed, posting a 19% decline, nearby markets are stepping up: New Jersey surged by 27% year-over-year, and we’re personally seeing more investors shift their focus there.

- Private buyers are driving the bulk of activity, accounting for roughly $23.5B over the last four quarters. Institutional groups follow with $6.1B, keeping healthy diversification in the market.

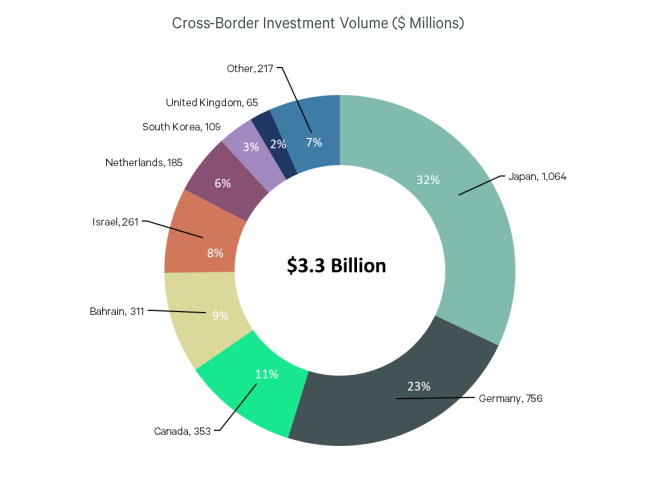

- International capital has cooled a bit — down 8% YoY — but domestic players have more than filled the gap.

CRE Sector Highlights We’re Tracking Daily

- Multifamily remains king. With $2.6B in Q2 volume, demand for well-located, value-add, or stabilized rental assets continues to dominate our client conversations.

- Office surprised to the upside. Despite the macro headlines, we still saw $2.2B in trades. Activity is concentrated in quality assets with strong tenancy or repositioning potential.

- Industrial keeps proving its resilience, generating $1.7B in Q2 — fueled by logistics, last-mile demand, and tight supply in several tri-state submarkets.

- These figures reflect only single-asset and portfolio sales of real property — no development sites — which gives us a clearer view of true transactional demand.

Where We Think the Market Is Headed

From our broker desks, the tone of the market feels very different from a year ago. The 11% rise in Q2 sales volume tells us investors are no longer sitting on the sidelines. They’re underwriting faster, touring more aggressively, and looking for ways to get ahead of pricing shifts before interest rates adjust further.

The softness in Manhattan doesn’t worry us — instead, it underscores a rebalancing. Investors are widening their search to markets offering better yields and fewer barriers to entry. Meanwhile, the slight dip in foreign capital is more of a reflection of global caution than local fundamentals.

Overall, we believe the tri-state region is entering a healthier, more active phase. Multifamily and industrial remain strong pillars, office is stabilizing in pockets, and private buyers continue to set the pace. As long as confidence holds and financing remains accessible, we expect this momentum to carry through in 2026.

For the latest news, proven strategies, and exclusive opportunities in commercial real estate in New York City and Western Nassau County NY, visit us at www.nyccrea.com

FOLLOW US:

Facebook: www.facebook.com/newyorkcityCREA

Instagram: www.instagram.com/nyccrea

LinkedIn: www.linkedin.com/company/nyccrea